India and the United Kingdom recently signed the Comprehensive Economic and Trade Agreement (CETA), a bilateral free trade agreement marking a major milestone in their long-standing partnership. Government of India has described this as “a historic and ambitious deal to boost jobs, exports, and national growth.”

The successful conclusion of negotiations as announced on 6th May 2025 reflects the shared ambition of two major economies to deepen economic ties. The current Bilateral trade between the two has already reached USD 56 billion, with the target to double this by 2030.

The agreement goes beyond goods and address services, a core strength of India’s economy. India exported over US$19.8 billion in services to UK in 2023, and CETA promises to expand this further.

India-UK bilateral annual trade ~USD 56 billion

Total merchandise-trade ~ USD 23 billion

Total services trade ~ USD 33 billion

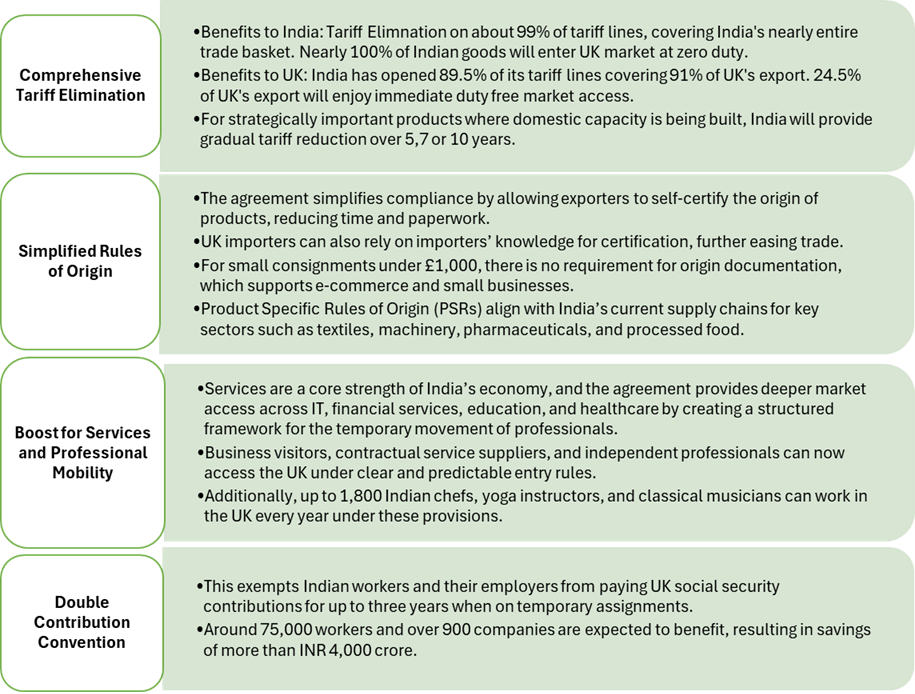

Key Features of the Agreement

Key Benefits as Summarized by both Sides

| Enhanced Market Access | UK exports: 90% of UK tariff lines will face reduced tariffs, benefiting products like whisky, gin, automotive, medical devices, cosmetics, aerospace components, lamb, salmon, electrical machinery, soft drinks, chocolate, and biscuits. Whisky and gin tariffs will decrease from 150% to 75% initially, and to 40% over a decade. Automotive tariffs will drop from over 100% to 10% under a tariff rate quota system. Indian exports: 99% of Indian tariff lines, covering nearly 100% of trade value, will benefit from zero duty, opening massive export opportunities for sectors like textiles, marine products, leather, footwear, sports goods, toys, gems, jewellery, engineering goods, auto parts, engines, and organic chemicals. |

| India has secured wide-ranging commitments from the UK, covering all 12 major service sectors and 137 sub-sectors, which represents over 99 per cent of India’s export interests. These include key areas such as IT and IT-enabled services, financial services, education, healthcare, professional services (accountancy, engineering, and management consultancy), telecommunications, and aviation support services.Ambitious UK commitments in digitally delivered services will enable:continued robust growth in IT and Business Services to expand pie (from 14 bn USD) in around 200 bn USD imports of UK.Indian start-ups to enter the UK market with reduced compliance friction and appeal to a wider customer basesupport the expansion of GCCs that serve U.K.-headquartered businessesOn the Indian side, commitments have been extended in 108 sub-sectors, granting UK firms access to domains like accounting, auditing, financial services (with FDI capped at 74 per cent), telecom (100 per cent FDI allowed), environmental services, and auxiliary air transport services.India’s market access in areas such as Professional Services, Business Services, Financial Services and Environmental Services will:- Facilitate investments into Indiabring technology and competitivenessPotential to serve global markets | |

| Economic Growth and Jobs | The FTA is projected to increase UK GDP by £3.3 billion by 2035 and support significant employment gains in India, particularly in labour-intensive sectors like textiles, leather, and footwear, aligning with the Indian government’s focus on job creation. Bilateral trade, valued at US$60 billion (£42.6 billion) in 2024, is projected to double to US$100 billion (£75 billion) by 2030, boosting national growth for both economies. |

| Services and Professional Mobility | Both countries have agreed to pursue Mutual recognition Agreements (MRAs) for professional qualifications within 12 months of the agreement’s entry into force, targeting fields like nursing, accountancy, and architecture.The FTA provides ambitious commitments for Indian services, including IT/ITeS, financial services, professional services (for example, in architecture and engineering), and educational services. This could make Indian service providers significantly more competitive in the UK. The agreement eases mobility for professionals, including contractual service suppliers, business visitors, investors, intra-corporate transferees, and independent professionals like yoga instructors, musicians, and chefs, offering “greater global mobility for aspirational young Indians”. This was a key demand from India.Importantly, no Economic Needs Test (ENT) is required, and no numerical restrictions will be placed on Professionals travelling to the UK for work. |

| Consumer Benefits | UK consumers can expect to enjoy lower prices on Indian apparel, shoes, and food items like marine products. Indian consumers may benefit from reduced costs on UK goods like whisky, cosmetics, and medical equipment. Access to cutting edge technology and investment is expected to boost employment opportunities. Commitments on digitally delivered services and streamlined customs processes enhance trade efficiency for both nations. |

| Double Contribution Convention | Previously, Indian employees and their employers had to pay nearly 20 per cent of salaries to the UK’s National Insurance system during short-term assignments without receiving any benefits in return. Under the DCC, such dual contributions are eliminated for stays of up to 36 months, benefiting more than 75,000 Indian professionals and 900 companies. Industry estimates suggest this will result in annual savings of over USD 500 million, significantly improving the competitiveness of Indian firms operating in the UK. |

Sector-Wise Service Benefits Under CETA

Information Technology and IT-Enabled Services

- The UK has taken full commitments in Computer and Related Services, giving certainty to Indian businesses planning to invest in the UK. This will strengthen the UK’s role as a key market for Indian IT companies and encourage further expansion. Reduced compliance costs and simplified processes will make operations easier for Indian firms, improving their efficiency and competitiveness.

- The agreement can deepen collaboration between Indian IT firms and UK small and medium enterprises. UK businesses will benefit from India’s expertise and cost-effective solutions in areas like digital transformation and cloud services.

- Mobility-related commitments will have a significant impact, making it easier for Indian IT professionals to work in the UK. Combined with the Double Contribution Convention (DCC), these changes will allow seamless and cost-effective talent movement. This is expected to drive collaboration in emerging technologies like fintech, artificial intelligence, and data analytics. Large IT players will gain from bigger contracts, while niche firms will benefit from innovation-focused partnerships.

Global Capability Centres

- The agreement aligns with India’s goal of becoming a global hub for high-value services. Greater UK investment and cooperation will boost India’s digital economy and skilling initiatives. For the UK, the deal offers access to one of the world’s fastest-growing technology markets.

- This agreement could shift UK companies’ approach to India—from a low-cost back-office destination to a strategic partner for research and development, analytics, cybersecurity, and emerging technologies. It will also support the growth of Global Capability Centres (GCCs) that serve UK-based businesses or deliver global services from India. India already hosts over 1,700 GCCs employing more than 1.9 million people, driving digital transformation for leading multinational companies.

Start-up Ecosystem

- India’s start-up ecosystem, with over 150,000 companies, will benefit from easier market access to the UK. The agreement reduces compliance hurdles, helping Indian start-ups reach new customers, especially in digital services. For Indian start-ups already operating in the UK, the DCC brings financial and operational advantages, making cross-border scaling simpler and more cost-effective.

Health and Education Services

- The agreement opens new opportunities for collaboration in health and education. UK’s commitments in private healthcare and education, combined with India’s offers in these sectors, create space for strong partnerships. Indian hospitals can work with UK counterparts to deliver better healthcare and adopt advanced medical technologies.

- UK educational institutions will be able to establish campuses in India, while Indian institutions can set up operations in the UK and expand in areas such as EdTech. The deal also benefits highly skilled Indian medical professionals, who already play a vital role in the UK’s National Health Service. Provisions on mutual recognition agreements will further smoothen their entry into the UK workforce.

Financial Services

- The agreement encourages UK investment in India’s fast-growing financial market, which can introduce innovative and competitive services while maintaining sectoral stability. Indian financial firms will gain better access to the UK, improving their ability to serve the Indian diaspora and businesses there.

- Non-discrimination rules guarantee fair treatment for Indian firms, while transparency commitments ensure UK regulations remain objective and clear. The agreement is also expected to support the growth of electronic payments, fintech, and other digital financial solutions, strengthening overall market integration.

India Protects what matters

- India has safeguarded its sensitive sectors—dairy, cereals and millets, pulses, and vegetables to high-value items like gold, jewellery, lab-grown diamonds, and certain essential oils, critical energy fuels, marine vessels, worn clothing, and critical polymers and their monofilaments, smart phones, optical fibres — a strong stand to protect farmers, MSMEs, and national interests.

- India has opened 89.5% of its tariff lines, covering 91% of the UK’s exports. 24.5% of the UK’s export value will enjoy immediate duty-free market access.

- Strategically important products—particularly those where domestic capacity is being built under flagship initiatives like Make in India and PLI—concessions provided over periods of 5, 7, or even 10 years with gradual tariff reduction

- India has gradually and selectively opened its market for alcoholic beverages

For automobiles India has given calibrated, phased, and development-oriented quota-based liberalization strategy while simultaneously protecting sensitive segments of India’s automotive industry.

Key Sectors Impacted

| Sectors in UK | Sectors in India |

| Beverages (whisky and gin): Tariff reductions boost Scotch whisky exports to India, the world’s largest whisky market. (Source). Automotive: Tariff cuts enhance competitiveness of UK cars and parts. Advanced Manufacturing: Electrical machinery, optical products, and aerospace components benefit from reduced barriers. Life Sciences: Medical device firms gain from lower tariffs and simplified rules of origin. Clean energy: Access to India’s renewable energy market supports UK firms in sustainable energy. Services: Financial, professional, and business services see increased market access. | Textiles and apparel: Zero duty on shirts, trousers, dresses, and bed linen boosts exports and jobs. Leather and footwear: Tariff elimination drives export growth and employment. Agriculture and marine products: Grapes, mangoes, and marine products gain competitive edge. Sports goods and toys: Duty-free access opens new market opportunities. Gems and jewellery: Enhanced access strengthens India’s global position. Engineering and auto parts: Exports of engineering goods, auto parts, and engines increase. Organic chemicals: Tariff concessions improve competitiveness. IT and Services: Ambitious commitments in IT/ITeS, financial, professional, and educational services create jobs and opportunities. |

Conclusion

India and the UK have been in negotiations for the FTA for many years and a mutually benefit deal is a welcome move for both the economies. By going beyond reducing tariffs to create a framework for cooperation in goods, services investments, and innovation this agreement marks a new chapter in the partnership between the two dynamic economies.

An elimination/reduction of tariffs on goods exported to the UK will provide significant boost to Indian exporters and an opportunity to explore a new market. At the same time, the Indian consumer would be able to enjoy several goods originating in the UK, at a comparatively cheaper price.

CETA is not just a trade agreement. It is a strategic partnership for the future, creating pathways for prosperity for both nations and their people.