Green financing refers to the strategic enhancement of financial flows from banking, micro-credit, insurance, and investment channels across public, private, and not-for-profit sectors to support sustainable development priorities.

It emphasises robust management of environmental and social risks, encourages investments that offer both competitive returns and measurable environmental gains, and promotes higher standards of transparency and accountability in financial decision-making.

Green growth refers to economic progress achieved alongside reductions in pollution and greenhouse-gas emissions, lower waste generation, and more efficient use of natural resources. Realising this vision demands long-term capital commitments and sustained financing. While public budgets have historically supported green infrastructure, fiscal constraints mean that large-scale private investment is now indispensable for the transition to a green economy.

Governments therefore play a pivotal role in strengthening policy and regulatory frameworks that can stimulate and mobilise private finance. This includes aligning and reforming policies across sectors to remove barriers to green investment and to create an enabling environment that attracts both domestic and international capital.

The OECD’s Green Finance and Investment series contributes to this effort by providing analysis and policy guidance aimed at scaling up financing and investment in technologies, infrastructure and enterprises essential for a low-carbon, climate-resilient and resource-efficient economy.

The promotion of green financing may be advanced through the reform of national regulatory frameworks, the harmonisation of public financial incentives, and the expansion of green capital flows across all sectors.

Key measures include:

- aligning public-sector financing decisions with the environmental objectives of the Sustainable Development Goals;

- increasing investment in clean and environmentally sound technologies; and

- supporting sustainable, natural resource–based green economies as well as climate-resilient blue-economy initiatives.

Moreover, the broader utilisation of green bonds and other specialised financial instruments will be essential for mobilising large-scale capital towards environmentally sustainable development.

Green finance has now firmly entered the mainstream. As the risks associated with environmentally harmful products and services continue to rise, it is anticipated that the preference for purchasing and investing in environmentally sustainable alternatives will, over time, become standard practice.

Sustainable Development Goals (SDGs) and Green Financing

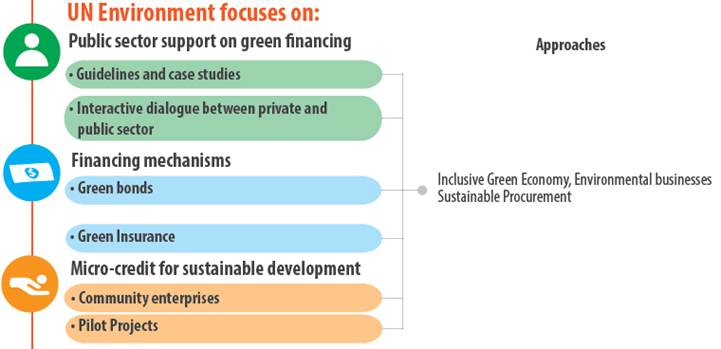

UN Environment is engaged with national governments, financial regulators, and the finance industry to align financial systems with the 2030 Sustainable Development Agenda, thereby ensuring that financial flows are directed toward the achievement of the Sustainable Development Goals (SDGs). Within the globalized economy, financial markets occupy a central position, as banks and investors determine the allocation of capital across sectors—decisions that will influence future ecosystems as well as patterns of production and consumption.

The principal areas of focus in the current green financing efforts include:

- Assisting the public sector in establishing an enabling policy and regulatory environment;

- Promoting public–private partnerships to advance financing mechanisms, including green bonds;

- Building the capacity of community enterprises to access and effectively manage micro-credit facilities.

How Does Climate Finance And Green Finance Differ?

Climate finance is a subset of green finance and refers primarily to financial resources often public funds provided by developed countries through bilateral or multilateral channels aimed specifically at supporting global efforts to mitigate and adapt to climate change.

Green finance, by contrast, is a broader concept. It encompasses all financial flows, from both public and private sources, that contribute to achieving wider environmental objectives, including biodiversity conservation, pollution reduction, sustainable resource management, and the transition to a low-carbon, climate-resilient economy.

India’s Green Finance and Investment Landscape

India has made significant strides in promoting green finance and investment, aligning its financial systems with sustainable development objectives. According to the Global Progress Report by the Sustainable Banking and Finance Network (SBFN, 2021), India’s journey toward a green financial transition began in 2011 with the issuance of the National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business by the Ministry of Corporate Affairs, later updated in 2019. In the same year, the Climate Change Finance Unit was established under the Ministry of Finance, Department of Economic Affairs to serve as the nodal agency for climate finance, assess international negotiations, and develop national capacity for analysing climate financing issues (Ministry of Finance, 2011).

In 2015, India launched the India Innovation Lab for Green Finance, as part of the global Innovation Lab for Climate Finance initiative, to support the development of innovative financing instruments. These include a rooftop solar private-sector financing facility, a peer-to-peer lending platform for SMEs, and a foreign exchange hedging mechanism to facilitate large-scale foreign investment in the renewable energy sector (Prakash et al., 2016). In 2016, the Indian Banks’ Association (IBA) joined the Sustainable Banking and Finance Network, alongside 86 member institutions from 66 countries. India is currently positioned in the “Developing” sub-stage of the implementation phase of sustainable banking and finance (SBFN, 2021).

The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have been instrumental in advancing green finance and investment in recent years. In 2015, RBI expanded priority sector lending to include social infrastructure and small renewable energy projects, thereby promoting investments in clean energy. In 2022, RBI and SEBI jointly issued a Sovereign Green Bond Framework, aligned with the ICMA Green Bond Principles, to enhance transparency and credibility in green bond issuance. Building on this, RBI issued sovereign green bonds worth INR 8,000 million in 2023 and introduced a Green Deposit Framework, creating a new instrument to broaden green financing opportunities for Indian citizens. In the same year, SEBI launched a new category of mutual fund schemes designed to encourage ESG investing and associated disclosures (SEBI, 2023).

Efforts to strengthen reporting standards and transparency have been central to India’s green finance agenda. Key initiatives include the National Voluntary Guidelines for Responsible Financing by the National Banking Association and SEBI’s Disclosure Requirements for Issuance and Listing of Green Debt Securities (2017). The Bombay Stock Exchange (BSE) issued ESG guidance in 2018, and in 2020, SEBI introduced the Business Responsibility and Sustainability Reporting (BRSR) Framework. Under this framework, ESG reporting and disclosure were made mandatory in 2023 for the top one thousand listed companies, significantly expanding corporate accountability from the initial top 100 firms.

Collectively, these initiatives reflect India’s growing commitment to integrating environmental sustainability into financial systems, fostering innovation in green finance, and creating a robust ecosystem for sustainable investment that aligns with national and global climate and development priorities.

While India has achieved remarkable improvements in energy efficiency and the adoption of renewables, decarbonising the Indian economy and achieving net-zero emissions by 2070 will require an acceleration in the deployment of new technologies. Offshore wind and green hydrogen stand out as strategic opportunities to help achieve India’s clean energy targets. The market uptake of these technologies would facilitate the shift to clean power generation and to low-carbon processes in industry. Significant energy efficiency opportunities also remain untapped. Drawing upon the strong Indian manufacturing ecosystem, deploying these technologies can provide quick and significant benefits across various sectors.

Conclusion

India has made significant strides in building a green finance ecosystem, integrating sustainability into financial systems, investment practices, and regulatory frameworks. Initiatives by the RBI, SEBI, and other institutions—such as green bonds, priority sector lending, ESG reporting, and innovative financing mechanisms—have strengthened transparency, accountability, and capital mobilization for clean energy and sustainable development.

Looking ahead, achieving net-zero emissions by 2070 will require accelerated deployment of emerging technologies, enhanced energy efficiency, and continued public-private collaboration. India’s efforts position it as a regional leader in green finance, demonstrating the potential to align economic growth with environmental sustainability.